ATTENTION: CONCERNED INVESTORS

BREAKING: NVIDIA CRUSHES EXPECTATIONS WITH $11B BLACKWELL DEBUT, STOCK SURGES IN AFTER-HOURS TRADING

NVIDIA DELIVERS RECORD QUARTER, SILENCES DEEPSEEK CONCERNS

20 chip surge validates Chinese demand as earnings top expectations; Blackwell achieves fastest ramp in company history

|

Editor's Note: Nvidia just delivered a landmark earnings report, with revenue surging to $39.3 billion and Blackwell chip sales hitting an unprecedented $11 billion in their first quarter. With Q1 guidance of $43 billion crushing expectations and silencing DeepSeek concerns, tonight's results could accelerate the AI infrastructure buildout. Our analysis suggests this marks a pivotal moment for tech spending in 2025. A trusted partner has just released time-sensitive presentation that I believe warrants your immediate attention. Nvidia's "Silent Partners" have Feb. 26 circled in redNvidia's Next Big Move Comes on Feb. 26 Inside the crucial data that could reshape tech investing in 2025. |

Nvidia delivered a knockout fourth quarter with revenue soaring to $39.3 billion, up 78% year-over-year, decisively answering questions about Chinese demand and DeepSeek's impact. The results exceeded Wall Street's expectations of $38.1 billion, while earnings per share of $0.89 topped estimates of $0.85.

Blackwell's Record-Breaking Debut

In a stunning validation of Chinese tech giants' recent buying spree, Nvidia revealed $11 billion in Blackwell architecture revenue - marking what CEO Jensen Huang called "the fastest product ramp in our company's history." Data center revenue reached $35.6 billion, significantly beating analyst expectations of $34.1 billion and confirming earlier reports of aggressive ordering by major Chinese firms.

Donald Trump just won the election resoundingly. And already, in the first few hours after the news, Bitcoin has skyrocketed. Hitting all-time highs on the first day after the election. But that’s just the start …

Juan Villaverde called the top and bottom of every crypto bull market since 2012. And he says 2025 could be the greatest bull market in crypto history. He believes Bitcoin will go to $150,000 — or more.

But there’s one coin he thinks could go even higher. It’s part of Trump’s special Project Crypto. His plan to make America “the crypto capital of the planet.” This could be his favorite coin.

And it’s definitely one of his vice president’s favorite. Click here to find out more about the coin that makes more than Bitcoin in the 2025 bull market.

DeepSeek Effect: A Catalyst, Not a Threat

Addressing recent market concerns about DeepSeek's efficient AI models, Huang turned the narrative on its head: "Demand for Blackwell is amazing as reasoning AI adds another scaling law - increasing compute for training makes models smarter and increasing compute for long thinking makes the answer smarter." The company's commentary suggests DeepSeek's innovations are driving demand rather than diminishing it.

Forward Guidance Fuels Optimism

Looking ahead, Nvidia projects Q1 revenue of approximately $43 billion, surpassing analyst expectations of $42.3 billion. This robust outlook comes despite looming concerns about potential Trump administration tariffs and export restrictions, suggesting the company's growth trajectory remains firmly intact regardless of geopolitical headwinds.

|

Nvidia's Next Big Move Comes on Feb. 26 Nvidia's "Silent Partners" have Feb. 26 circled in red Nvidia continues to lead the pack when it comes to AI… Following a year when the AI chip giant became just the third company ever with a market cap greater than $3 trillion… There are no signs of slowing down in 2025. Wednesday, Feb. 26 is the next key date for Nvidia. That is when its latest quarterly earnings call takes place. And get this, the last time Nvidia had this call, in November… It announced year-over-year gains in one key AI sector of 112%. Now, with Nvidia already dominating AI's newest frontier ... A move that was recently valued at more than $1 trillion… The Feb. 26 call could skyrocket Nvidia's stock even further. And Nvidia isn't the only company eagerly awaiting this call… You see, companies partnering with Nvidia on this AI journey have already seen their own stocks soar.

Companies like ASML, up as much as 500%…

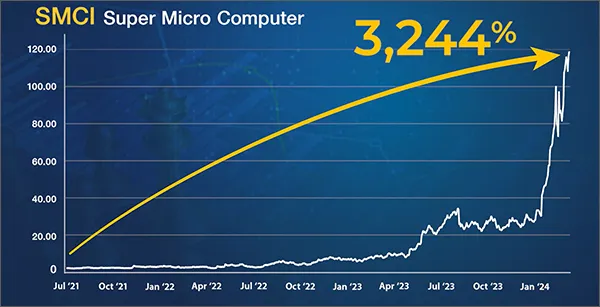

SMCI, up as much as 3,244%…

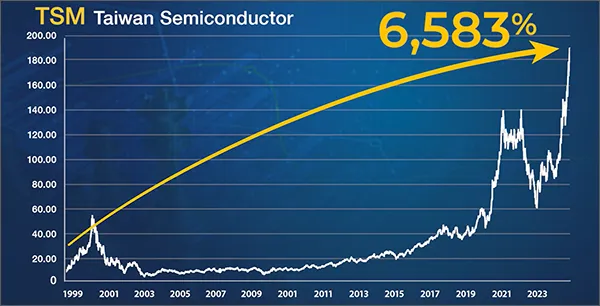

And TSM, up as much as 6,583%. Now, with Nvidia's recent move to this $1 trillion Superproject… On Feb. 26, a small handful of Nvidia's other partners could see their own stocks surge upward. |

Disclaimer

TechStockMovers.com operates under Market Insiders Media dba and Sandpiper Marketing Group, LLC. We are not registered investment advisers or broker-dealers and operate under the publisher's exclusion from investment adviser regulations. Our content is for informational and entertainment purposes only - we do not provide investment advice.

Our content represents opinions based on public information and research. Nothing we publish is a recommendation to buy, sell, or hold any security. All information is general in nature and not tailored to individual investment needs.

Trading securities, especially penny stocks, carries substantial risk. You could lose your entire investment. Always consult qualified investment, tax, and legal professionals before making any investment decisions. Conduct thorough independent research.

Our staff may hold positions in securities mentioned in our content. We may receive compensation for publishing information about companies, which we fully disclose when applicable. Sponsored content is paid advertising and not endorsed by our staff.

By accessing our content, you acknowledge this disclaimer and confirm that you understand our content is for informational and entertainment purposes only. You rely solely on your judgment and professional advisors for investment decisions. Past performance does not guarantee future results.