ATTENTION: CONCERNED INVESTORS

NVDA Earnings Call TODAY

Nvidia's Make-or-Break Moment

$3 Trillion on the Line as Earnings Loom

|

Editor's Note: As Nvidia approaches its critical February 26 earnings report, Wall Street is holding its breath. With a $3 trillion market cap at stake and mounting concerns about infrastructure spending, DeepSeek disruption, and potential Trump export controls, tonight's announcement could mark a decisive moment for AI stocks. Our analysis suggests the implications extend far beyond just Nvidia's numbers. A trusted partner has just released time-sensitive research that I believe warrants your immediate attention. Nvidia's "Silent Partners" have Feb. 26 circled in redNvidia's Next Big Move Comes on Feb. 26 Inside the crucial data that could reshape tech investing in 2025. |

With just hours remaining until Nvidia's most anticipated earnings release of the year, Wall Street holds its breath. The AI chip giant, which has defined the artificial intelligence boom and helped create unprecedented wealth, now faces a perfect storm of challenges that could reshape the entire AI investment landscape.

Market Sentiment Turns Electric

Trading floors are buzzing as Nvidia's stock has shed over 9% in just five trading days. The company that briefly touched a $3 trillion market cap now stands at a critical inflection point. Tonight's report isn't just about numbers – it's about whether the AI revolution's poster child can maintain its extraordinary trajectory in the face of mounting headwinds.

The Hyperscaler Drama Intensifies

A shadow of doubt has crept into the market following reports of Microsoft's data center lease cancellations. With Morgan Stanley revealing that Microsoft alone accounts for 35% of projected Blackwell chip spending in 2025, followed by Google at 32.2%, every word about hyperscaler spending in tonight's report could send shockwaves through the market. While Microsoft has reaffirmed its $80 billion infrastructure commitment, investors remain on edge.

Donald Trump just won the election resoundingly. And already, in the first few hours after the news, Bitcoin has skyrocketed. Hitting all-time highs on the first day after the election. But that’s just the start …

Juan Villaverde called the top and bottom of every crypto bull market since 2012. And he says 2025 could be the greatest bull market in crypto history. He believes Bitcoin will go to $150,000 — or more.

But there’s one coin he thinks could go even higher. It’s part of Trump’s special Project Crypto. His plan to make America “the crypto capital of the planet.” This could be his favorite coin.

And it’s definitely one of his vice president’s favorite. Click here to find out more about the coin that makes more than Bitcoin in the 2025 bull market.

Something strange is happening in Silicon Valley...

Microsoft, Google, and Amazon are making unusual preparations...

All ahead of Nvidia's February 26th announcement.

These aren't normal business moves we normally see from Big Tech...

They're emergency measures.

And I suspect it's because they know what's coming next.

A critical flaw in the AI revolution...

One that could throw Trump's entire tech agenda into chaos.

The mainstream media still hasn't connected the dots...

But Wall Street insiders have already started positioning themselves.

DeepSeek's Disruption: Nvidia's Moment of Truth

Tonight, CEO Jensen Huang must address the elephant in the room: January's DeepSeek announcement that temporarily vaporized $600 billion in market value. Huang's bold stance that efficient AI models actually increase chip demand faces its biggest test yet. His "Test Time Scaling" theory suggests that AI's future demands more chips, not fewer – but will the market buy it?

What This Could Mean for Investors

As the closing bell approaches, three critical questions hang in the balance: Can Blackwell chips maintain Nvidia's technological edge? Will hyperscaler spending hold up against economic headwinds? And how will Nvidia navigate the increasingly complex geopolitical landscape of chip exports to China? Tonight's earnings call could provide the answers that determine whether Nvidia's AI dominance enters a new chapter – or faces its first serious challenge.

The stakes couldn't be higher. With major cloud providers projecting unprecedented infrastructure investments for 2025, tonight's report could either validate Nvidia's position as the AI revolution's kingmaker or signal a shifting of the tides. In just a few hours, we'll know which way the winds are blowing.

|

Nvidia's Next Big Move Comes on Feb. 26 Nvidia's "Silent Partners" have Feb. 26 circled in red Nvidia continues to lead the pack when it comes to AI… Following a year when the AI chip giant became just the third company ever with a market cap greater than $3 trillion… There are no signs of slowing down in 2025. Wednesday, Feb. 26 is the next key date for Nvidia. That is when its latest quarterly earnings call takes place. And get this, the last time Nvidia had this call, in November… It announced year-over-year gains in one key AI sector of 112%. Now, with Nvidia already dominating AI's newest frontier ... A move that was recently valued at more than $1 trillion… The Feb. 26 call could skyrocket Nvidia's stock even further. And Nvidia isn't the only company eagerly awaiting this call… You see, companies partnering with Nvidia on this AI journey have already seen their own stocks soar.

Companies like ASML, up as much as 500%…

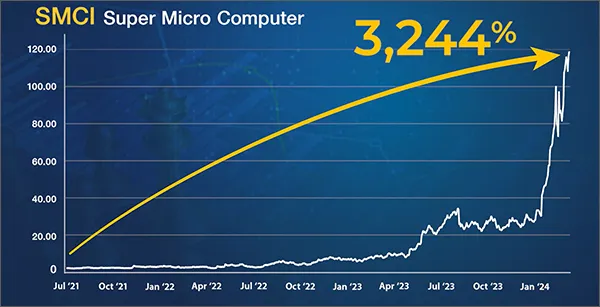

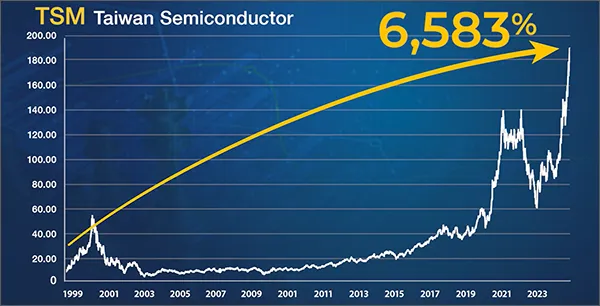

SMCI, up as much as 3,244%…

And TSM, up as much as 6,583%. Now, with Nvidia's recent move to this $1 trillion Superproject… On Feb. 26, a small handful of Nvidia's other partners could see their own stocks surge upward. |

Disclaimer

TechStockMovers.com operates under Market Insiders Media dba and Sandpiper Marketing Group, LLC. We are not registered investment advisers or broker-dealers and operate under the publisher's exclusion from investment adviser regulations. Our content is for informational and entertainment purposes only - we do not provide investment advice.

Our content represents opinions based on public information and research. Nothing we publish is a recommendation to buy, sell, or hold any security. All information is general in nature and not tailored to individual investment needs.

Trading securities, especially penny stocks, carries substantial risk. You could lose your entire investment. Always consult qualified investment, tax, and legal professionals before making any investment decisions. Conduct thorough independent research.

Our staff may hold positions in securities mentioned in our content. We may receive compensation for publishing information about companies, which we fully disclose when applicable. Sponsored content is paid advertising and not endorsed by our staff.

By accessing our content, you acknowledge this disclaimer and confirm that you understand our content is for informational and entertainment purposes only. You rely solely on your judgment and professional advisors for investment decisions. Past performance does not guarantee future results.