ATTENTION: TECH INVESTORS

Pro-Crypto President Meets Market Forces: November's Triple Alignment

The Political Shift

The cryptocurrency landscape stands at a historic crossroads as Washington's stance undergoes a dramatic transformation. With bold pledges to make America "the crypto capital of the planet" and establish a strategic Bitcoin reserve, the new administration marks a decisive break from previous approaches. The election of over 260 pro-crypto candidates to Congress creates what industry experts are calling the first "crypto Congress," suggesting unprecedented support for digital asset innovation.

Donald Trump just won the election resoundingly. And already, in the first few hours after the news, Bitcoin has skyrocketed. Hitting all-time highs on the first day after the election. But that’s just the start …

Juan Villaverde called the top and bottom of every crypto bull market since 2012. And he says 2025 could be the greatest bull market in crypto history. He believes Bitcoin will go to $150,000 — or more.

But there’s one coin he thinks could go even higher. It’s part of Trump’s special Project Crypto. His plan to make America “the crypto capital of the planet.” This could be his favorite coin.

And it’s definitely one of his vice president’s favorite. Click here to find out more about the coin that makes more than Bitcoin in the 2025 bull market.

Technical Timing

This regulatory sea change coincides with a crucial milestone in Bitcoin's evolution. The recent halving event, occurring only once every four years, has historically preceded significant market movements. Previous cycles show that while Bitcoin typically sees substantial gains following halvings, select alternative cryptocurrencies often outperform by factors of 3 to 20 times.

Institutional Response

Major financial institutions aren't waiting for further signals. BlackRock and Fidelity are pioneering tokenized funds, while VISA and Mastercard expand their crypto payment networks. U.S. cryptocurrency exchanges report record volumes, with stablecoin transactions now outpacing traditional payment networks. This institutional embrace suggests a fundamental shift in how the financial sector views digital assets.

Global Impact

The implications extend far beyond U.S. borders. European markets, which have led in crypto regulation with MiCAR, are now watching as America positions itself to potentially take the lead in digital asset innovation. Global competition for crypto dominance intensifies as nations like the UAE and Switzerland establish robust frameworks to attract crypto enterprises.

Why November Matters

Industry experts emphasize that timing is crucial. The convergence of political support, technical catalysts, and institutional adoption points to early November 2024 as a potential turning point. As the crypto market matures and mainstream adoption accelerates, the window for early positioning may be narrowing.

What This Means for Investors

For investors, this alignment presents both opportunity and complexity. While the potential for significant returns exists, navigating the evolving landscape requires sophisticated market analysis and careful timing. Many are turning to crypto investment experts with proven track records of identifying similar opportunities in previous cycles.

Looking Ahead

As Washington's stance shifts from skepticism to support, and major institutions accelerate their crypto initiatives, the digital asset market of 2025 could look radically different from today. The key isn't just understanding that change is coming – it's knowing exactly where to position oneself before it arrives.

[Editor's Note: For an in-depth analysis of the most promising opportunities in the current crypto market, click on the presentation below.]

did this article make sense? If so...

YOU NEED TO CLICK BELOW...

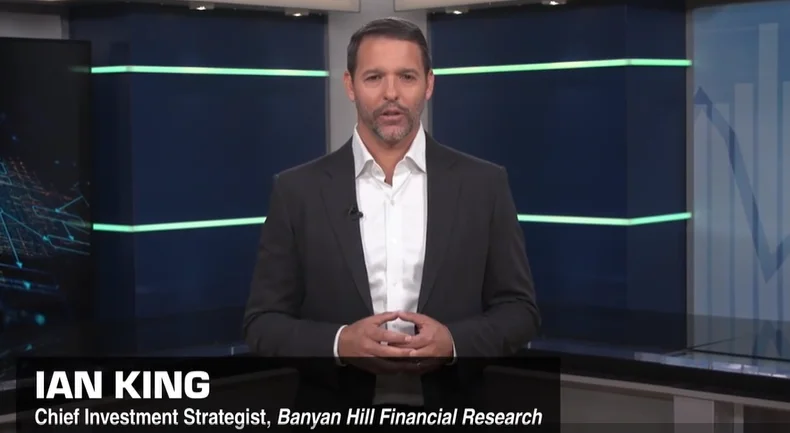

Ian King is one of America's top crypto experts for good reason.

When Bitcoin crashed in 2020, the media called it "dead money." But Ian saw something different...

He recommended three unknown cryptos that soared:

Binance shot up 1,061% in 10 months

Solana rocketed 1,934% in just 5 months

Luna peaked at an incredible 18,325% in one year

Now, Ian sees an even bigger opportunity ahead...

He's identified 3 "under-the-radar" cryptos set to potentially explode after January 19th.

One combines the two hottest technologies in the world - crypto and AI. And at just $5, anyone can get in.

This could be your last chance for major crypto gains. Here's why:

Bitcoin is going mainstream. Major banks, ETFs, and institutions are piling in. The days of Bitcoin creating new millionaires are over.

But Ian's research shows these 3 little-known cryptos could deliver massive returns when Bitcoin makes its final bull run.

The window closes January 19th. After that, Ian believes this opportunity disappears forever.

Go here to see how to get Ian's 3 crypto picks before January 19th.

TRENDING STORIES

Silicon Valley visionary who called Nvidia at 80 cents reveals what’s …BEYOND AI

Artificial intelligence is at a crossroads. Now, Bill Gates, Sam Altman and Jeff Bezos are spending billions on a strange investment in a quest to secure AI’s future. “Nvidia is old news … This is where the money is headed in tech stocks.”

When the Government Releases Certain Data, Either Good or Bad...You Can Target Up to +383% Overnight

(See the Proof!) New Trade Goes LIVE THIS TUESDAY at 2 pm

See this facility? Billionaires like Ken Griffin, Ray Dalio and Steven Cohen are pouring a ridiculous amount of money into the company behind this A.I. project…Because it will supply a key piece of advanced A.I. technology for Elon Musk’s new venture, xAI. Click here to see the details.

Disclaimer

TechStockMovers.com, a brand under Market Insiders Media dba, operates under the parent company Sandpiper Marketing Group, LLC. Please be advised that TechStockMovers.com is not registered as an investment adviser or broker-dealer with the United States Securities and Exchange Commission or any state regulatory agency. We rely on the "publisher's exclusion" from the definition of investment adviser as set forth in Section 202(a)(11) of the Investment Advisers Act of 1940, as amended, as well as corresponding state securities laws. Consequently, TechStockMovers.com does not offer or provide personalized investment advice.

The information we provide is based on our opinions, statistical and financial data, and independent research of public information. Our materials are intended for informational purposes only, and no mention of a specific security in any of our content constitutes a recommendation to buy, sell, or hold that or any other security. Any information deemed to be investment opinion is impersonal and not tailored to the investment needs of any individual.

Please be aware that TechStockMovers.com does not promise, guarantee, or imply that any information provided through our websites, newsletters, reports, or printed material will result in profit or loss. We strongly encourage you to seek personal advice from your professional investment, tax, or legal advisors and to conduct your own due diligence and independent investigations before acting on any information we publish or making any investment decision. Only you and your professional advisors can determine the level of risk appropriate for you. Penny stocks, in particular, are inherently speculative investments, and you should be prepared to lose your entire investment.

Employees, owners, and/or writers of TechStockMovers.com may own positions in the equities, options, and/or securities mentioned in our content. However, no associated employees will intentionally engage in any transaction that directly or indirectly competes with the interests of our subscribers. TechStockMovers.com may be compensated for publishing information about companies referred to in our reports, newsletters, and websites, and we provide full disclosure of such compensation.

Furthermore, please note that any content marked as "Sponsor" may be paid for and is not endorsed or warranted by our staff or company. The content in our emails is for educational or entertainment use and is not a substitute for professional advice or an offer to buy or sell any securities. Neither the publisher nor the editors are registered investment advisors (RIA’s) and do not provide personalized counseling. Be sure to conduct your own careful research and consult with your advisors before taking any action based on our content. By opening our emails or clicking any links contained therein, you are reconfirming your opt-in status, which is part of your free subscription.